Headlines

News

Intense Digital, the application of print enhancements

September 26, 2017 By Jon Robinson

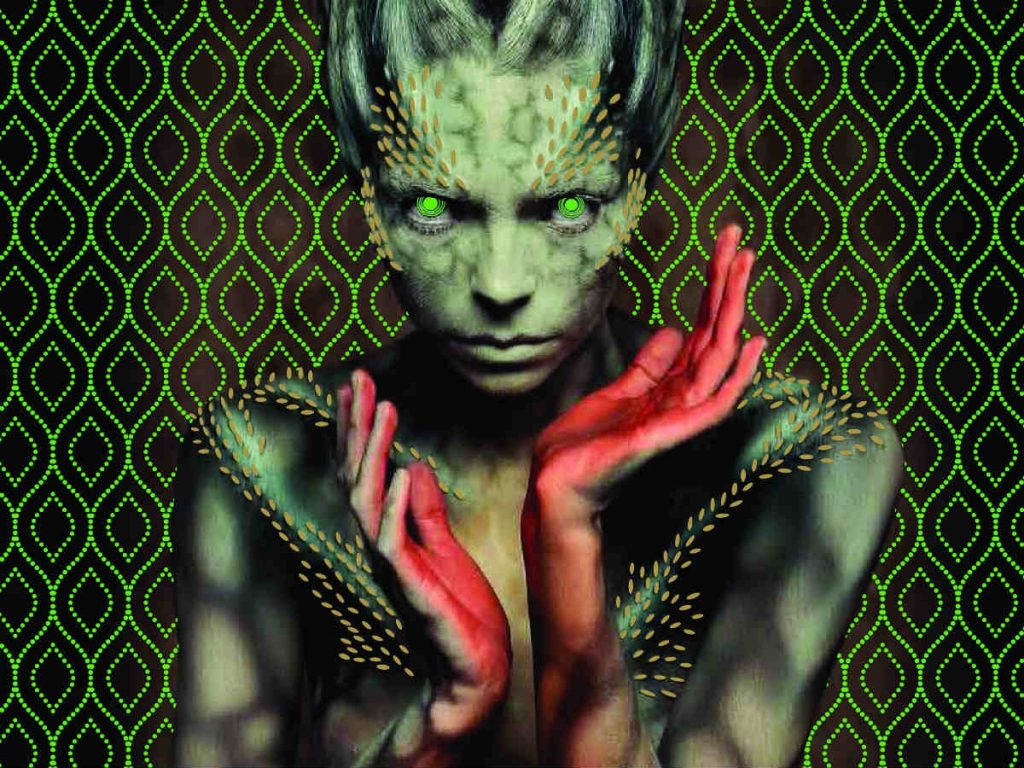

PrintAction’s cover was produced by BOSS LOGO Print & Graphics on its new UltraPro Foil system, featuring this prepress file image applied with Scodix Foil (gold) and Sense (green) applications.

PrintAction’s cover was produced by BOSS LOGO Print & Graphics on its new UltraPro Foil system, featuring this prepress file image applied with Scodix Foil (gold) and Sense (green) applications. The emergence of enhancement and embellishment technologies are generating new possibilities for print to capture the attention of marketers and higher margins for commercial operations.

InfoTrends estimates approximately 30 percent of the total colour pages printed in North America and Western Europe, or nearly 1.8 trillion pages, currently receive some form of special effects enhancements or embellishments. These statistics are pulled from a 2016 report called Beyond CMYK: The Digital Print Enhancement Opportunity, coauthored by Jim Hamilton, Group Director of InfoTrends, who explains this relates to a range of value-add special effects like spot or flood coatings, adding a Pantone colour, metallic inks, opaque whites, fluorescents, security features or any number of CMYK+ features.

The vast majority of these 1.8 trillion enhanced pages are printed offset and finished with conventional methods. In fact, the report found that 46 percent of enhanced offset printed material requires two or more enhancements. There has been recent growth in digitally printed pages receiving enhancements because most toner-press makers now provide a fifth station for inline treatments, but Hamilton estimates this is applied to less than 10 percent of all digital pages and less than three percent of total production colour digital pages receive special effects.

Hamilton also points to the recent uptake in offline digital enhancement systems introduced from companies like Scodix, Konica Minolta (MGI), Duplo and Steinemann to apply spot gloss, dimensional, foil and other effects. Beyond CMYK estimates, however, the digital print enhancement market (both inline and offline) only amounts to about nine billion pages annually. “That may seem like a lot, but it’s just a tiny sliver compared to the total 1.8 trillion print-enhanced colour pages produced each year,” Hamilton explains. “The conclusion is pretty clear. There is a significant growth opportunity for digital print enhancement processes.”

The opportunity in digital enhancement outlined by Hamilton helps to describe two of the three strategic pillars leading the development and commercialization of Scodix technology. Founded in 2007 by Eli Grinberg and Kobi Bar, Israel-based Scodix introduced its first digital enhancement system in 2010 and then caught the attention of the printing world at drupa 2012 for its unique application of polymers to enhance print – both offset and digital pages. Today, these polymers can be used in nine different or combined enhancement applications on three system platforms including the Scodix S, Scodix Ultra and the recently introduced 41-inch Scodix E106.

The Value Category, as described in large part by Beyond CMYK’s research focus, was Scodix’ initial push to the market in 2012 based on the ability to apply spot textures on a page through what are now branded as Sense polymers. Scodix’ introduction of a digital foil enhancement module in late-2015 supported its existing value-add approach, but also introduced a Cost Replacement Category of commercialization for the system maker. The third strategic pillar is referred to by Scodix as the Dream Category, which relates to a printer’s ability to attract completely new work based on enhancing pages.

Cost replacement foil

Scodix’ value and dream categories are often hard to quantify because numbers will shift based on the type of application being produced, run length and a printer’s sales ability to create a demand for enhanced pages. Cost replacement, however, provides printers with solid numbers in their application of digital foil relative to the costs of insourcing or outsourcing such analogue work.

“Scodix is building a story about how they have grown and it is closely linked to the availability of what we call digital foil,” says Christian Knapp, owner of Toronto-based CMD Insight, who serves as the Canadian agent for Scodix. He has worked with Scodix for the past two years and been involved with almost half of the 11 Scodix installations in Canada, with a twelfth nearing completion. “[Texture] is very interesting but somewhat limited in its application and adoption by the market. Once Scodix brought out digital foil they opened up the parameters completely… and they experienced substantial growth simply because the market realizes digital foil fits the cost replacement model and that is what most commercial, and in fact other, printers are going for.”

Approximately 150 Scodix systems were sold during drupa 2016. There are around 50 Scodix installations currently in North America and now more than 250 worldwide. Knapp believes the technology has moved past the early adopter stage, when printers were initially intrigued by texture, into an early majority phase. “Any return on investment calculations for a commercial printer require, on the one hand, to reduce costs in their business and, on the other hand, offer new technology. And digital foil together with texture, what we call Sense printing, gives us that ability,”

Knapp says, relating to the set-up time of traditional hot and cold foiling methods suitable only for long runs, and the direct costs of outsourcing. The ability to apply digital foil naturally fits with the digitalization of prepress and presses, as most commercial printers today face a higher number of daily print-work transactions.

“Once you go from that product life cycle early adopter to early majority, people are starting to look at that in much more detail,” Knapp says. “Now the calculators come out and people need to justify their investments and let’s face it these machines are not inexpensive.”

Knapp explains a base Scodix Ultra system, onto which modules can be added, sells for approximately US$600,000 and the foiling unit is around US$150,000, resulting most often in a machine set up for around US$750,000 all in. “In calculations for customers, I have been able to justify the investment on the foiling unit alone within less than 12 months,” he says, noting the ROI on many full systems can be done in the range of 24 to 28 months. “That is fairly aggressive for a product that is not a small investment.”

Value and profit

In addition to the cost replacement models that help drive Scodix ROI calculations, Knapp also points to the value-add category where printers can simply charge more for print work when it is enhanced. He explains that traditional coating is actually more of an enabling technology relative to true page enhancements applied through systems like those built by Scodix. “Coating enables you to participate in the market, but you cannot really add that much value. Because at that level there is a market price that is highly fought over and there are lot of competitors in this segment,” Knapp explains. It is rare for an offset press to be sold today without a coating unit and coating holds as much customer expectation as sharp CMYK work, as much as service provides client loyalty but not necessarily a premium price.

When discussing value-add, Knapp is directly referring to profit contribution for a printer based on page enhancements. He provides the example of a printing company that generates $10 million turnover, which is a suitable revenue number for Canada’s majority of small- to mid-sized printers. “If you are a good printer, well regarded, and have high productivity, you might make five percent margin so there is $500,000 on a $10 million turnover,” he explains. “Now take the Top 10 percent of your customers and convert that with value-added processes such as Scodix digital foil and digital embossing. For that $1 million, if your profit number is now, to simplify things, 50 percent, you are making $500,000 profit on that volume.”

Knapp explains by maintaining the remaining $9 million of turnover at five percent margin, which is about $450,000 profit, and adding the Scodix profit from VIP clients, a printer might generate around $950,000 for the same $10 million business turnover. “In that example, if you wanted to make $950,000 profit on a five percent margin for a conventional business you would have to produce about $19 million in sales. We all know how difficult it is to grow a commercial print business from $10 million to $19 million.”

The example of achieving 50 percent margin on Scodix print work would certainly need to be adjusted depending on how it is being applied and for what select clients. A high margin figure, however, is not unrealistic for enhanced print. “Special effects printing can be a profitable endeavour,” wrote Hamilton, based on the Beyond CMYK report. “According to InfoTrends’ research, print buyers will pay premiums in the range of 24 to 89 percent for digital print enhancements over CMYK-only work. Interestingly, many buyers expressed a willingness to pay a higher premium for special effects than printers believed they would pay.”

Knapp points to three third-party studies that suggest a premium margin for enhanced print comes in at anywhere from five to 40 percent. These studies, however, focus on a range of enhancements including lower-value coatings and not exclusively Scodix-level work.

Power of vision and touch

The California Institute of Technology (Caltech) conducted an experiment in which the end user price sensitivity was tested in respect to tactile print enhancement. The researchers concluded that price increases are possible by adding soft-touch tactile features to packaging whereby brands could raise prices to end-users by up to five percent.

The British Royal Mail looked at measuring user interaction with direct mail back in February 2015 in a survey called Private Life of Mail, which included looking at the effects of tactile printing on a reader’s emotional responses. The study states: “Behavioural marketing experts, Decode, scanned recent academic literature for us to see what had been discovered about the importance of touch in human psychology. They demonstrated that there are strong reasons why getting consumers to engage physically with a brand is likely to have a strong effect on them. Multi-sensory stimulation seems to alter the way the brain processes messages – often making processing quicker, which is key for driving emotional response to messages or brands.” The Royal Mail’s study found that a sense of ownership over a printed item derived from sight and touch translates into a 24 percent increase in value.

Earlier this year, Canada Post – through True Impact Marketing – produced its own study called A Bias For Action that used brain imaging and eye-tracking technologies to see into the brains of people interacting with physical (direct mail) and digital (email, display) advertising media. The researchers developed two integrated campaigns featuring mock brands, applying the same creative and messaging across both physical and digital media formats. The 270 participants were later given memory tests to assess their recall of branded material.

True Impact Marketing found that it takes 21 percent less thought to process direct mail over digital messaging, and that the paper product creates a 70 percent higher brand recall – that our brains process paper media quicker than digital media. Researchers found the motivation response created by direct mail is 20 percent higher and even better if it appeals to more senses like vision and touch. “Physical fills a much-needed, and very human, sensory deficit in the virtual world, where we spend most of our time these days…The most important renaissance in advertising has gone largely unnoticed,” wrote Deepak Chopra, CEO of Canada Post, in a guest column for The Globe and Mail about the study.

Research by the Foil & Specialty Effects Association in 2013, in a study called Results of Impact of High Visibility Enhancements, concludes that there are overwhelming responses for what it calls First Fixation of foil stamped packaging. The authors explain, “The ability of a product to attract the shopper’s visual attention has a strong influence on a consumer’s decision to purchase.” The study found that foil can increase sales prices by 10 to 40 percent depending on the end product.

“We have a number of instances where people are charging $30 for 500 business cards, for example,” says Knapp. “Business cards are a dead giveaway market for this type of technology, compared to maybe only $10 for a conventional, standard CMYK business card.” He explains Scodix is currently focused on five target markets where it can add value: Commercial print, Web-to-print (such as business cards), folding-carton convertors (based on the introduction of the 41-inch Scodix E106), book publishing and photo-books.

The cost of polymer, explains Knapp, is always a point of discussion with printers when doing ROI calculations, especially as it relates to value-add, but he does not see it as a significant factor. “We encourage them to not put down too much polymer, because you will then lose the uniqueness, the ability to make this page standout,” he says. Knapp explains the worldwide average of Scodix polymer usage per page on a B2 sheet, 28 x 30 inches, is somewhere in the range of seven percent. “That is fairly low and the cost for a page produced like this is then in the range of 12 to 15 cents U.S. So that is actually not that much, especially if you can sell every one of those pages for a dollar or more, $5 – it depends on the application.”

Dream polymers

The third pillar of commercialization for Scodix, beyond value and cost-replacement, is referred to by the company as the dream category, based on a printer’s ability to increase sales outside of existing product offerings and clients. “It doesn’t fly very well in the hard-nosed business world of commercial printers,” says Knapp, who began his printing career by spending more than two decades selling offset technologies. “We mention it to people because we know this happens, but in a return on investment calculation it is very difficult to quantify.”

It is logical, however, that opening up VIP clients to enhanced print with texture and foil can help attract more of their offset or digital printing work, while at the same time provide a route into new accounts through differentiation. This is also fuelled by the development approach of Scodix based on the fact that most of its research effort is put toward polymers to expand beyond its current nine applications, which are branded as Sense (texture), Foil, Foil on Foil, Spot, Metallic, Glitter, VDP/VDE, Braille, Crystals and Cast&Cure.

Knapp explains Scodix views itself as chemical company more so than just a hardware company, focusing on engineering machine platforms to leverage new polymers and applications. “The future may well have polymers with a specific light frequency that reacts or they may taste or smell,” he says. “There are so many markets where a unique polymer or application would have great benefits. Think of security, foods, packaging in general. There are lots of applications that this technology will go to in the future.”

The polymers are a major differentiator for Scodix in the market relative to traditional inks and coatings, as well as the growth in new electrostatic inks for fifth and sixth imaging units. Knapp explains, “Scodix always determines the ideal and right polymer for the print job. Its modular [system] philosophy is application specific to what the end user needs and it is a very open R&D-centric company.”

Knapp continues to explain the use of polymers also provides an advantage for the vast majority of commercial printers who produce work-and-turn jobs, because Scodix jobs can be processed quickly with efficient drying. He also points to Scodix’ machine build, weighing around 9,500 pounds, and the registration accuracy of the systems as advantages.

“The underlying theme for Scodix, has always been to make printers more profitable,” says Knapp. “That is how I see their differentiation. I can talk technical Olympics for hours if that is what we need to do, but in the end it really comes down to providing tools for printers to be successful.”

Print this page