Headlines

News

Understanding Productivity and Profitability

November 21, 2017 By Dr. Ron Davis Chief Economist PIA

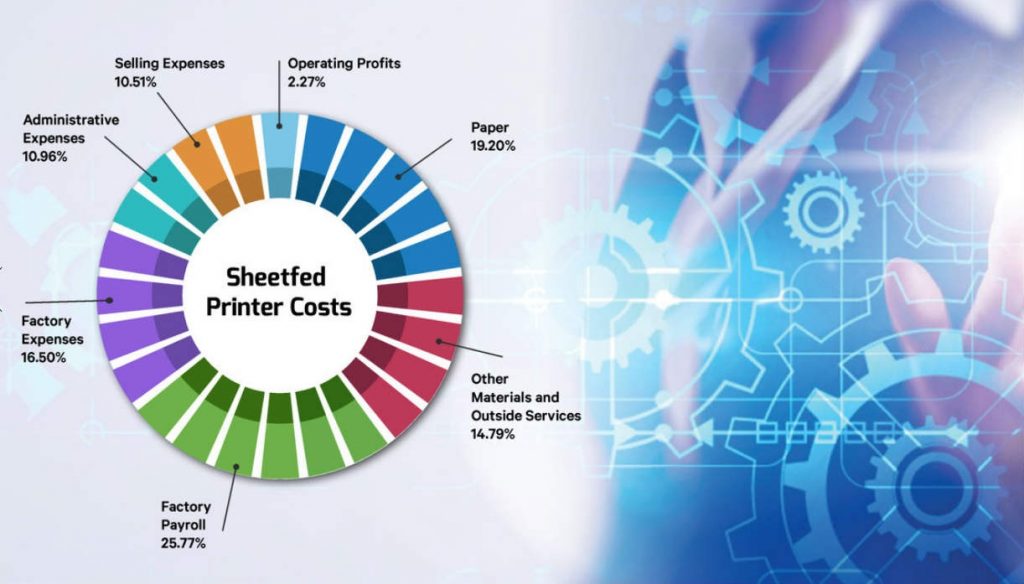

The complex recipe for print production results in over 100 separate cost-expense items for a typical printer’s chart of accounts. However, these can be grouped into the main categories shown here.

The complex recipe for print production results in over 100 separate cost-expense items for a typical printer’s chart of accounts. However, these can be grouped into the main categories shown here. The key to lower cost and higher profits in the printing industry revolves around managing new world automation

Today’s printing industry is a capital-intensive business that is a hybrid of production, distribution, and ancillary services. In this article, I examine the relationship between productivity and profitability in print, using independent industry data for sheetfed commercial printers covering primarily commercial and advertising, direct mail and packaging, while the budgeted hourly rates are from an industry accepted source.

First, let’s define productivity from an economic perspective. Productivity is the connection between inputs (resources used to produce a good or service) and outputs (the quantity of goods or services produced). Productivity goes up if we can produce more output for the same amount of inputs or produce the same amount of output with fewer inputs.

In the printing industry, typical economic metrics for productivity are sales per employee, sales per factory employee, or value added per employee or factory employee. Here I focus on the value-added component. A comparison of these metrics for sheetfed printers dramatically demonstrates how much more productive profit leaders (top quartile of profitability) are than those with profit potential (lower quartile of profitability). For example, profit-leading printers produce in excess of 44 percent more value added per production worker than those with profit potential.

It is important from a business’ perspective to understand what underlying reasons for this differential. A vital reason for this competitive advantage in productivity is the difference in machinery and equipment per factory employee. Data indicates high-profit printers are much more likely to substitute capital for labour. In fact, high-profit printers have almost double the investment per factory employee compared to low-profit printers.

Why is capital investment an important factor in profitability? Higher investment on the factory floor equates to less labour in the factory. Indeed, high-profit printers use approximately 30 percent fewer factory employees per million dollars of sales. For comparison purposes, a $10-million profit-leading printer would have 17 fewer factory employees than a printer with profit potential. This reduction in staffing significantly impacts the profitability of the printer.

This comparative focus on equipment and efficiency allows high-profit printers to achieve a big reduction in direct labour cost as a percentage of value added with a savings of around seven percent (Figure 2).

It is important to understand how this lower cost is achieved. The cost to manufacture an item is comprised of material costs, cost to produce it (budgeted hourly rate or BHR), and how many of the item can be produced over a period of time (productivity). Let’s consider a simple case of two manufacturing scenarios for the same item. The first has a BHR of $300 and net productivity of 1000 items per hour, while the second has a BHR of $360 and net productivity of 1500 items per hour. In the first case it costs $0.30 per item, while in the second it costs $0.24 per item.

The second manufacturing scenario, while at a higher BHR, has a lower manufacturing cost. This clearly demonstrates that both BHR and productivity should be considered in tandem when evaluating your manufacturing costs.

Now, let’s examine in more detail the connection between the cost of equipment (in this case a press), the BHR, and press productivity. In general, the depreciation and finance cost of a new press makes up between 20 to 35 percent of budgeted hourly rates. The remainder of the BHR is composed of manufacturing labour, other manufacturing costs, and sales and administrative costs.

On this basis, higher equipment costs translate to only approximately a 6- to 10-percent increase in BHR depending on the factors above. This could be considered a significant difference in a competitive industry like printing. However, this difference is significantly impacted by any productivity difference in equipment as indicated above.

In the example for a typical two-shift operation, a 25-percent premium in equipment costs is equalized by an 8.75-percent difference in equipment productivity, a factor defined as the productivity equalizer. In general, productivity is three times more important than price differential between equipment. Therefore, in this case, at any productivity difference above 8.75 percent, the business would reduce costs and increase profitability despite paying 25 percent more for the equipment.

The bottom line is that productivity driven by automation, innovation, and technology-embedded equipment drives down costs and increases financial performance. The key to managing this complex process is to understand the dynamics of the interactions better than your competitors.

Impact of cost on profitability

Pinpointing how costs impact profitability in the printing industry is critical for printers to understand and leverage in their businesses. The underlying drivers of profitability are sales or total revenues, prices they charge, and cost structure.

In general, increased sales, higher prices, and lower costs all add to the bottom line and the profitability of companies. Last year, a typical sheetfed printer’s costs comprised just under 98 percent of total sales, leaving only two-percent profits across the industry. Often in today’s print market, there is a “street price” for the product, above which the printer cannot increase their pricing unless there are additional value-added services. Printers can increase profitability by analyzing their sales and operations, making business changes that increase sales volumes, and or lowering their manufacturing costs.

The complex recipe for print production results in over 100 separate cost-expense items for a typical printer’s chart of accounts. However, these can be grouped into the main categories shown in Figure 1 (top of page 14). In this data, for an average sheetfed printer the manufacturing costs cover the majority of the costs at 76 percent. This is made up from the factory payroll (all factory employees, benefits, etc.), factory expenses (rent, insurance, power, etc.) paper, materials, and outside services.

Admin and selling costs account for 22 percent, leaving just over two-percent average profitability. Clearly, reducing the costs indicated above will impact companies’ profitability. So what happens to profits as companies reduce costs? As profit margins are typically slim, profits increase disproportionally to a given percentage-cost decrease. For example, a one percent decrease in manufacturing costs (factory expenses and payroll, paper and other materials/outside services) translates to a 34-percent increase in profits, other things remaining equal. Therefore, achieving a three-percent reduction in the manufacturing costs doubles profits! A one-percent decrease in overall total costs translates to a 43-percent jump in profits.

There are two key drivers for lower costs: First, more equipment, specifically newer and more productive equipment, for manufacturing. Second: fewer but more productive and higher-paid people. These two factors working in tandem are the crucial determinants of the profit gap between industry profit leaders (sheetfed printers in the top quartile of profitability) and the rest of the industry (the other 75 percent of the industry) where over the last 10 years there has been, on average, a 10-percent profit differential between these groups.

A primary path to higher profitability for printing companies is lowering cost. This will also, by definition, increase the sales conversion rate and therefore also increase total sales. By leveraging manufacturing efficiency, printers can turbocharge their profitability.

Print this page