Features

Business

Research

Global inkjet market to reach US$100B by 2023

October 4, 2018 By Smithers Pira

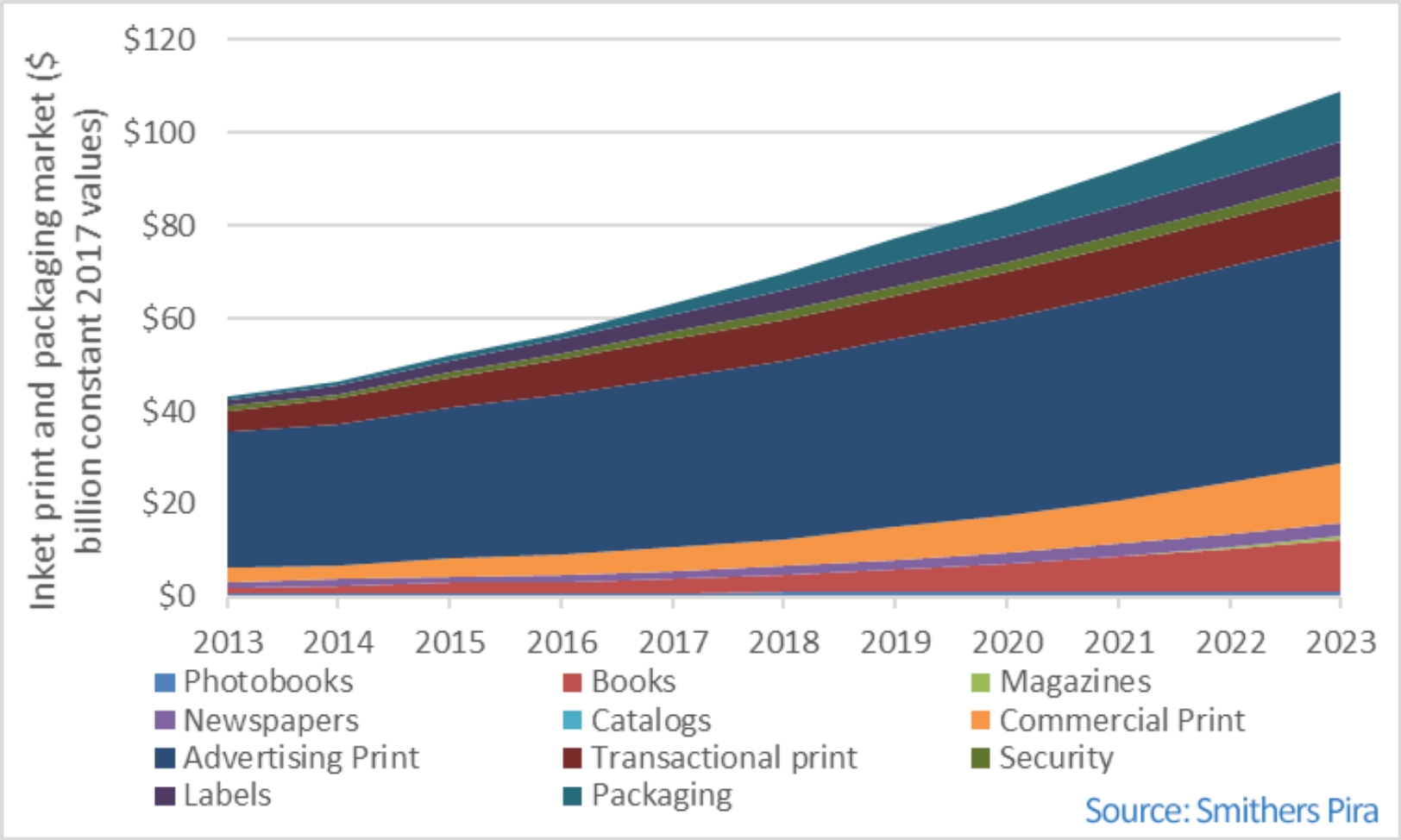

Value in the world inkjet market will rise at 9.4 percent across the next five years according to the latest research from Smithers Pira. This will push a market worth US$69.6 billion (all figures in U.S. dollars) globally in 2018, to a value of $109 billion in 2023. The volume of work on inkjet presses will rise from 748.7 billion A4 prints to 1.42 trillion across the same period.

This attractive growth prospect contrasts favourably with the overall outlook for printing, where declining output of graphics and publication print means value increases are only a 1.0 percent year-on-year.

As the worldwide print market transforms, shifts in buyer demands – shirt runs, versioned and personalized products and higher quality are aligning with the capabilities of inkjet. This is making it a key focus technology developers. Smithers Pira analysis shows that across the next five years inkjet will grow, both by deepening it penetration into existing markets, and exploiting new emergent market opportunities.

Productivity returns

With the market proposition of inkjet printing now qualified, there is an increasing drive to improve the productivity of inkjet presses. In May 2018 HP, for example, announced it was upgrading its PageWide T1100S press, adding extra colours and boosting the top speed in the T1190S model to 305m per minute. This makes the most productive digital print engine 67 percent faster, raising output (without bleed) from 8,215 to 13,692 A4 prints per minute. That is more than five times faster than a B1 printing press operating at 20,000 sheets per hour.

Simultaneously less powerful machinery is being aided by improved workflow solutions and greater automation in material handling. This is common in high-performance flatbed printers but is also being witnessed on other formats. This trend was illustrated in May at Fespa 2018 by Cannon Océ, with a sophisticated robotic handling system that enables its Arizona 6170 XTS machine to interface with a ProCut cutting table from Rolan Robotics. The robot positions boards onto the Arizona bed, it can turn them over and place them accurately on the cutting table and then remove cut sheets or individual products into stacks for delivery or into a further production stage in a totally unattended operation.

For the user, like Dutch print service provider (PSP) Van Vliet Printing, the arrangement allows it to move to round-the-clock unattended printing for a range of medium-volume applications.

Changing priorities

In 2018 advertising – direct mail, promotional leaflets and fliers, display and signage – remains the most significant end-use market for inkjet printing. It will account for 55 percent of global inkjet revenue in 2018.

Advertising will remain a mainstay of the industry across the next five years, but its relative importance will decline to a 44 percent share in 2023. This is due both to a drop in end-user pricing of advertising inkjet print falls through changes in required media and use of more productive equipment; and also due to rapidly increasing use of inkjet in several other key sectors.

The three most noteworthy are:

• Book printing

• Commercial print

• Packaging print

Book printing

As book printing adjusts to the realities of a world where much media is in electronic format and shopping is dependent on online e-commerce channels, it is increasingly turning to inkjet print. Total value in this market will almost triple across 2018-2023, topping $11 billion at its end, and overtaking transaction print as the second largest inkjet segment by value.

Its ability to produce short runs or single books, minimal set-up, and easy integration with online ordering systems is benefiting book publishers and sellers, allowing them to minimize stock holdings and risk, improve turn around, and monetarize extensive back catalogues more rare or fringe interest titles.

The single-pass web inkjet press is central to this revolution, linking mono and colour presses to slick cutting and folding systems to deliver sections or blocks for near-line binding.

Commercial print

Inkjet is increasingly being used in commercial print applications, with wide-format and high-speed presses now being joined by the very high-quality sheetfed inkjet presses.

Many commercial print shops have focused on lower run work, but this is now changing high-quality sheetfed presses come onto the market and web press users broaden their applications. This is allowing inkjet to target the whole range of commercial products, like greetings cards, forms, business cards, stationery and envelopes, folders, postcards, playing cards, training and product manuals, newsletters, badges, programs, posters, non-promotional signage, and leaflets.

As inkjet builds in the commercial segment – roughly doubling in terms of value across the next five years – the share of work in mono overprinting will diminish in favour of full colour.

Packaging print

Packaging print is another segment set for an explosion in inkjet production across the next five years. Growth in labels will still be appreciable at around 10 percent year-on-year, but the most rapid transformation will be in direct packaging substrates with a suite of new machines targeting specific formats expanding the market at more than 25 percent each year.

Inkjet has long been used in preparation of prototypes and proofing of packaging, but has been slow to take off in production. There is real traction in 2018, however, as high-performance inkjet platforms come to market to print folding cartons, flexibles, rigid plastics, metal; and in particular corrugated board, with the single-pass preprint and postprint machines being adopted enthusiastically by converters.

At Fespa 2018, EFI Nozomi and HP announced new installations for their corrugated board presses And there was news of technical developments from Erajet, Macarbox, HP (see above), Koenig & Bauer, Durst and Sun Automation in the sector.

Equipment formats

In 2018 the value of new inkjet equipment is $3.6 billion, up from under $2.5 billion in 2013, and will top $4.1 billion in 2023. The thousands of wide-format printers sold currently amount to the largest sector; by 2023 this will be overtaken by high-performance web presses, with new designs for packaging applications becoming significant.

High growth is forecast in sheetfed platforms, where the single-pass B2 and B3 presses are being joined by new B1 designs and fast-developing larger-format corrugated postprint presses. The B1 presses shown at drupa 2016 are now coming to market. Innovative designs – including from Inca Digital with its traversing head Onset M B1 inkjet press – is seeing installations. The Landa S10 is the first indirect inkjet system in operation, while Canon is continuing to develop its Voyager machine.

Narrow-web inkjet presses, including the hybrid flexo/inkjet systems, are rapidly gaining share in label production, with flexible packaging a significant if secondary application. Most narrow web equipment uses UV curing inks, supplemented by water-based systems coming onto the market including the Memjet system in the new Gallus SmartFire.

The market for bespoke inkjet designs in graphics and packaging is falling as turnkey systems are developed for more applications. A key trend is the use of robotics to move heads into position to print irregular shapes, with industrial applications being explored, with direct printing of automotive and aircraft components one potentially lucrative area.

The full report, The Future of Inkjet Printing to 2023, is available for purchase now.

Print this page