A look at business succession planning for privately-held firms

You own and operate your own business. You are one of those people who enjoys the challenge of being your own boss, the master of your own destiny.

Now you are about to take on one of the greatest challenges to face any business owner — preparing and choosing new leadership for the business and planning for the transfer of its ownership. In short, the challenge of succession planning.

Whether it’s because you’ve reached an age where retirement has ceased being an abstract concept, a friend or family member has recently passed away, leaving you to wonder what your family would do in the same situation, or questions have started to arise from your children about the roles they will play in your company’s future, you’re not alone.

According to surveys conducted by Deloitte (2020) and PwC (2019):

- Ninety per cent of North American privately held businesses are family firms.

- Thirty-five per cent of Fortune 500 companies are family controlled.

- Forty per cent of the leaders of these firms plan to retire in the next five years.

- The mean age of the leader in family-controlled companies is 60.2.

- Eighty-two per cent do not have a formal succession plan.

What is succession planning?

Simply put, succession planning is all the thinking, planning, preparation and activities that take place in anticipation of and before a defined departure date.

In private companies, succession planning is a process that involves personal ownership, familial considerations and organization development. This process can be complicated further if accounting for family members working in the business, multiple shareholders, several businesses, high net worth and the desire to treat heirs equitably in estate planning.

The succession planning process

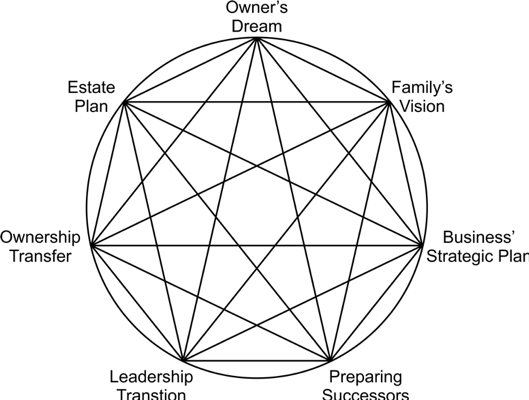

Succession planning means many things to many people. To some, it is an estate planning or financial planning task. To others, it is just a part of the strategic planning process. To still others, it’s about ensuring that management and executive leadership positions are filled by qualified people — a training and development task.

In my experience, the most effective succession plans are the ones that have been developed using an integrated, holistic approach. Each part has been undertaken with the whole in mind.

Succession planning is a component of strategic planning, yet just having a sense of what you’ll do is not a plan. In fact, only 18 per cent of privately held companies have one. There is a perceived lack of urgency to develop a formal exit plan that gets attention only when there is an unexpected accident, injury, illness or death. In the absence of a succession plan, any of these situations can become a crisis.

If you found out you only had six months to live, would you want to tackle your bucket list, or would you rather spend that time selling your business?

The best time to sell your business is when you don’t have to. And the best reason to sell is when you’re retiring. But without some thought and preplanning, it’s doubtful business owners will be able to sell when they’re ready because they don’t have an exit strategy and haven’t taken the steps necessary to get the full value for their businesses.

Are you ready?

Succession planning can seem overwhelmingly complex. It necessitates assessing the competencies of all involved parties. It involves personal issues, family issues and business management issues as well as legal, financial and taxation issues — all of which touch upon each other in a variety of ways.

In my experience, the minimum amount of time required to develop a succession plan is 2.5 years, but can be much longer if you intend to transfer ownership to second generation children working in the business.

Where to start? Here are a few suggestions.

- Have a Business Valuation prepared by a professional who sells businesses, is aware of the current marketplace and who can:

- Lead you through the sales process;

- Recommend structural reorganization to minimize taxes on transition;

- Facilitate a long-term strategic planning program;

- Perform a due diligence analysis of your business from a potential buyer’s perspective to identify corrective actions;

- Help you set up an advisory board of outside expertise;

- Identify property and/or excessive cash in the business that may disqualify your capital gains exemptions; and

- Refresh the valuation annually until you’re ready to sell.

- Assess future wealth requirements and the need for restructuring to reduce after-sale taxation that may require share redistribution and take two years to crystallize.

- COVID-19 has provided a unique opportunity for any kind of ownership transition over the next one to two years where it would be advantageous to have a lower share value.

- Business-owning families must pay special attention to the preparation of their children to step into the ownership circle through education, training, participating in strategic planning and assessment of their capabilities to work together and to fill your shoes. While children may already be working in the business, it will take several years in leadership and decision-making roles to create a cohesive family team.

You can come to succession planning from any number of directions. Whatever the approach, it is a process that every business owner has to deal with sooner or later. The world is full of business owners who unfortunately neglected to prepare a qualified, experienced successor or failed to put the financial structures in place that would fund their retirement and reduce taxation.

Your willingness to confront the task is in your hands. Effective planning can mean the difference between a smooth transition and chaos for your business. Everyone grows old, but effective planning can allow you to maintain control of your destiny in your “golden” years.

Linda K. Fairburn is an expert in succession planning and the bestselling author of Exit Right: A guided tour of succession planning for families-in-business-together. Her company, Make Things Happen, offers consulting, training and coaching to support succession planning and leadership change in family businesses.

This article was originally published in the November 2020 issue of PrintAction.

Print this page